Acorns Review 2023: Pros, Cons, and How It Works

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

The Acorns app helps you save and invest your spare change. When you link a credit or debit card, Acorns rounds your purchase up to the nearest dollar and invests the difference. However, the monthly account fees will have an impact on your returns.

Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. If a purchase or signup is made through one of our Partners’ links, we may receive compensation for the referral. Learn more here.

In this Acorns review, we’re going to show you how Acorns works, what the potential savings and risks are, and help you determine whether Acorns is a smart investment tool for you.

Remember your piggy bank or loose change jar you had as a kid? How you would drop all your nickels, dimes, and quarters in there until it was packed full?

If you’re like me, every time you brought that change in the bank it added up to more cash than you thought.

Acorns wants to take this “out of sight, out of mind” savings strategy to the next level. They round-up your expenses to the nearest dollar, then invest your nickels and dimes for future goals.

Recently, the company added retirement accounts, a debit card account, and a $10 sign-up bonus.

But can this micro-investing strategy really grow your wealth? Let’s take a look.

|

$0 per trade |

$1-3 per month |

$0 per trade |

| Designed for DIY investors | Beginner-friendly | Commission-free trading |

| Easy-to-use mobile app | Completely automated | Automated rebalancing |

| No account minimum | No account minimum | $100 account minimum |

|

Get 1 free stock |

$10 sign up bonus |

No sign up bonus |

What Is Acorns?

Acorns is part spare change jar, part robo-advisor. This app rounds up your purchases on linked credit or debit cards — now with the option to boost those round-ups by 2x, 5x, or even 10x — and invests that money for you.

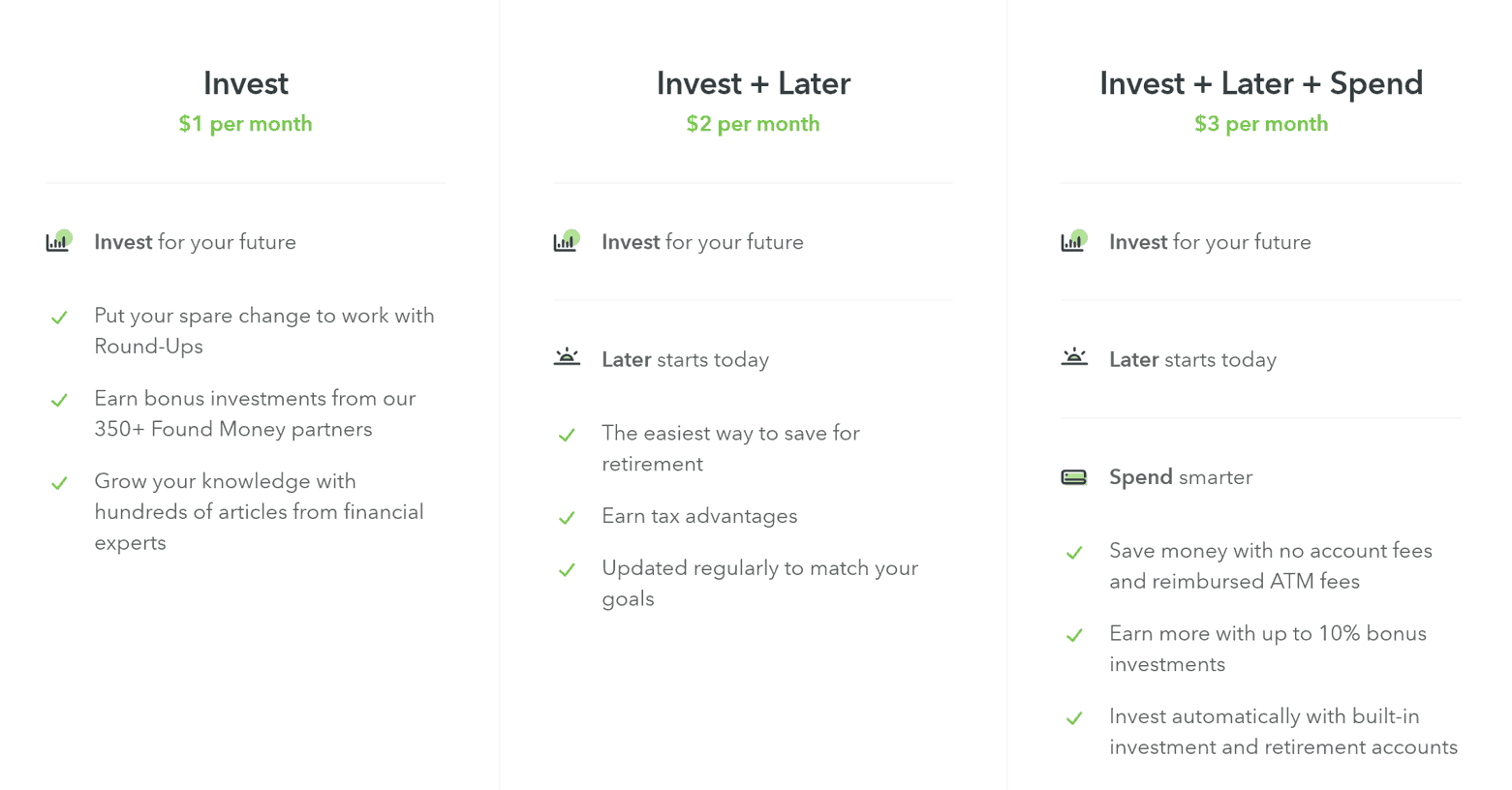

Acorns offers three levels of service:

Invest: $1/month

Summary: Round purchases up to the nearest dollar and invest the difference in a taxable account. Add cash to your investments regularly and get kickbacks to boost your investments from purchases at partner retailers.

For $1 per month, this is Acorns’ lowest cost option. To sign-up, you connect your bank account and link any credit and debit cards where you want round-up investments to occur.

Then you select the amount of money you want to contribute to your Acorns investment to get started. There is no minimum, but the app won’t actually begin investing for you until your Round-Up balance equals $5 or more.

Finally, you’ll answer some questions about your financial situation, goals, and risk tolerance. Acorns will use this to recommend one of its five ETF-based investment portfolios. You can override their selection if you want more or less risk in your portfolio.

In addition to your Round-Up investments, you can set recurring investments that occur daily, weekly or monthly. Acorns Found Money service is also partnered with over 200 brands that give you cash back, automatically invested, for purchases.

Note: This account level used to be free for college students for up to 4 years, but Acorns no longer offers this perk.

Invest + Later: $2/month

Summary: Original Acorns plus the ability to invest in an Individual Retirement Account (IRA).

In 2018, Acorns added retirement investments to their platform. Now you can invest in a Roth, Traditional, or SEP IRA with Acorns. Investments into your Acorns Later account occur the same way as with the original Acorns service.

Invest + Later + Spend: $3/month

Summary: Acorns online checking account with full bank services, FDIC insurance, and the ability to boost your Acorns + Acorns later investments with instant Round-Up and cash back from local retailers.

The most recent addition to the Acorns platform is a digital checking account. Acorns Spend is a full-service checking account allowing digital direct deposit, mobile check deposit and payment, and unlimited fee-reimbursed ATM withdrawals.

Acorns Spend allows for real-time Round-Ups, custom spending strategies to boost your savings, and increased Found Money cash-back with up to 10% invested from local places you regularly visit.

How Does Acorns Work?

Acorns’ investing service, like most robo-advisors, is based on Modern Portfolio Theory created by Dr. Harry Markowitz. It has five optimized portfolios to choose from and automatically rebalances your portfolio and reinvests all dividend payments regularly.

Each Acorns portfolio is made up of ETFs, or Exchange Traded Funds, with exposure across multiple asset classes. These ETFs have internal expenses that equal about 0.10% of your investment over time.

As you add money to your account through Round-Ups or scheduled deposits, Acorns will invest that money for you based on your risk-profile. If you are using the basic Acorns account, this will occur in a taxable investment account.

You can withdraw your money from Acorns at any time, but investment withdrawals can take 5 to 7 business days. And the reality is, you don’t want to use your Acorns savings as a regular source of cash.

Investing is a long-term game. By pulling money from this account for day-to-day expenses and goals, you’ll increase the chance of losing money in the market.

Acorns Review: Frequently Asked Questions

With so many options out there, investors have questions. Here are the top queries we’ve seen around the web that we’d like to cover in our Acorns review.

Are small Round-Up investments enough to matter?

When it comes to saving for your future, every little bit helps.

At the same time, should Round-Up investments be the core part of your investing strategy? No.

But even investing $30 a month at a 7% market return adds up to over $4,900 in 10 years. Put that same amount in an online savings or money market account, and you’re only looking at just under $3,900. And the gap between investing and saving only increases over time. That’s the power of compound growth.

How much does Acorns cost?

Acorns offers three plans:

- Invest, $1 per month

- Invest + Later, $2 per month

- Invest + Later + Spend, $3 per month

For small accounts, the $1 monthly fee is very high and offsets any reasonable potential gain from the investments.

Let’s assume you had 50 Round-Up transactions a month, at an average round up value of $0.40. The Acorns app would invest $20 for you each month but would take 5% of those savings in Acorns fees.

As your account value increased, that percentage would decline. But you would need to have $5,000 invested before Acorns’ fees were as low as Betterment at 0.25%. And Betterment offers those fees with no minimum investment threshold and with access to a retirement account. You would need $10,000 invested in an Acorns IRA to match Betterment’s fees.

What a $1/mo Fee Means for a Taxable Account:

| Account Balance | Annual Fee |

| $250 | 4.80% |

| $500 | 2.40% |

| $750 | 1.60% |

| $2,000 | 0.60% |

| $5,000 | 0.24% |

Are there risks with investing with Acorns?

As with any investment, performance isn’t guaranteed. Investing has risks which means the value of your portfolio can trend up and down over time. While the S&P 500 has consistently provided returns around 8% annually, year-to-year variations could mean your account loses substantial value — sometimes in excess of 10% or more.

The biggest risk for Acorns users is deciding to stop contributing to your account and keeping it small. Remember, the smaller your account balance remains, the more impact the monthly fee has on your overall account balance.

If you have plans for your money in the next three to five years, opt for a high-interest savings account instead.

Related: DollarSprout’s Chime Bank Review

Is it okay to invest large sums of money with Acorns?

For hands-off investors with large sums to work with, the flat-rate fee may look attractive. For example: If you have over $10,000 to invest in the Invest + Later membership level and your fees drop to below the levels of top robo-advisor competitors like Betterment and Wealthfront, Acorns appears to be a cost-effective option.

However, I would still not recommend investing large amounts with Acorns. Their investment options aren’t as robust as the bigger players. Portfolios include less diversification across asset types and no ability to customize asset allocation outside the five key portfolios.

In addition, if you are primarily investing in a taxable account (the basic Acorns level), you don’t get tax-loss harvesting to improve long-term returns offered by many competitors.

Finally, you don’t get access to professional financial support with Acorns. Larger robo-advisors provide some access to Certified Financial Planners (CFPs) to answer your burning questions. You might not have any today, but as your portfolio grows or we hit a downturn in the market, it can be a comforting option.

Who is Acorns best for?

Acorns is best for new investors who are looking for a hands-off solution to growing their savings.

Is Acorns Worth It?

When it comes to round-up investing apps, Acorns is among the best in the business. It’s easy to use, has an excellent education platform for new investors, and simple, straightforward fees.

However, whether the $1-3 monthly fee is a benefit or a detriment really depends on your account balance. If you’re only adding a few dollars a month to your Acorns account, that $1 a month will hinder your investment growth.

The Acorns app is easy to use and perfect for new investors who are learning the ropes. Investors make purchases using a linked card. Acorns rounds up to the nearest dollar and invests the extra change. Users can also set automatic recurring investments on a daily, weekly, or monthly basis.

Show Hide more